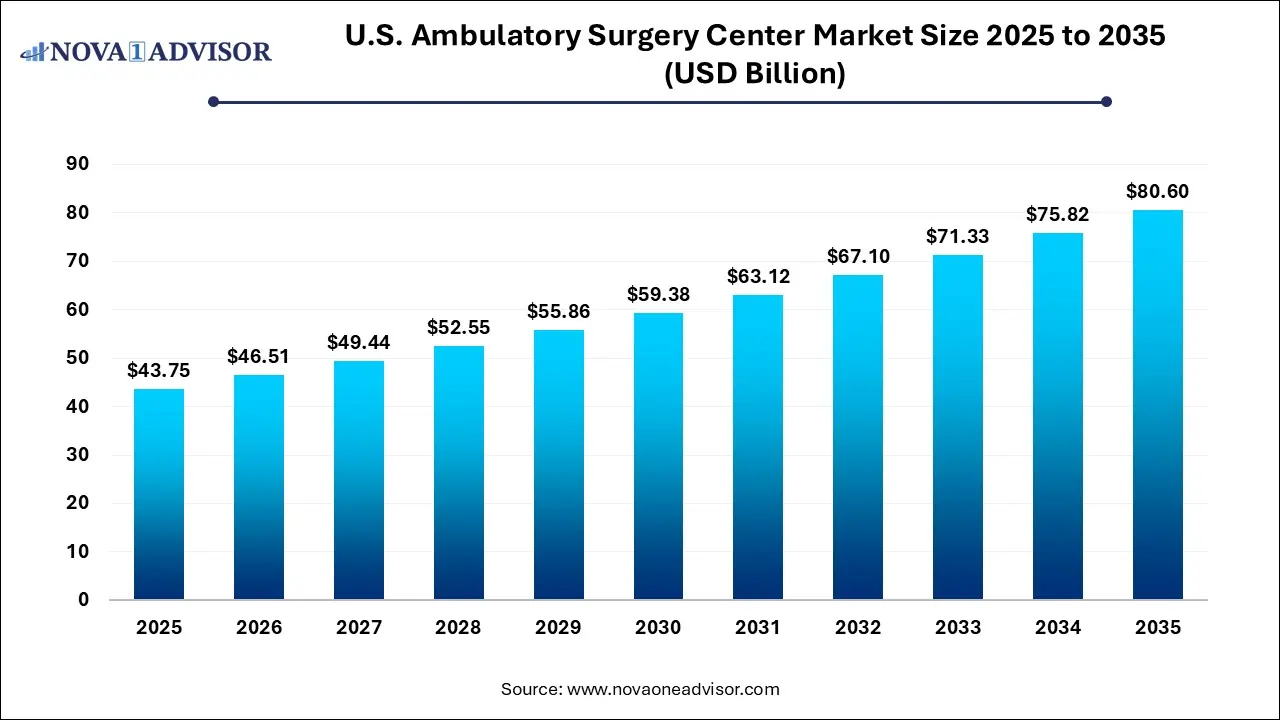

Ottawa, Jan. 29, 2026 (GLOBE NEWSWIRE) -- The U.S. ambulatory surgery center market size reached at USD 43.75 billion in 2025 and is expected to grow steadily from USD 46.51 billion in 2026 to reach nearly 80.60 billion by 2035, growing at a CAGR of 6.3% during the forecast period from 2026 to 2035, a study published by Nova One Advisor, a sister firm of Precedence Research.

The U.S. ambulatory surgery center market is set to grow steadily, driven by rising outpatient procedure volumes, expanding CMS reimbursement approvals, increasing physician and private equity investments, and the shift of high-complexity surgeries from inpatient hospitals to cost-efficient ASC settings.

U.S. Ambulatory Surgery Center Market Key Takeaways

- Based on region, the market is segmented into Southeast, West, Midwest, Northeast, and Southwest. The Southeast region accounted for the largest revenue contributed the largest market share of 11.7% in 2025.

- The Midwest region is expected to witness is estimated to expand the fastest CAGR during the forecast period.

- The orthopaedics segment generated the maximum market share of 12.1% in 2025.

- The otolaryngology segment is expected to witness the fastest growth during the forecast period.

- Based on ownership, the market is segmented into physician-owned, hospital-owned, and corporate-owned. The physician-owned segment captured the maximum market share of 23.19% in 2025.

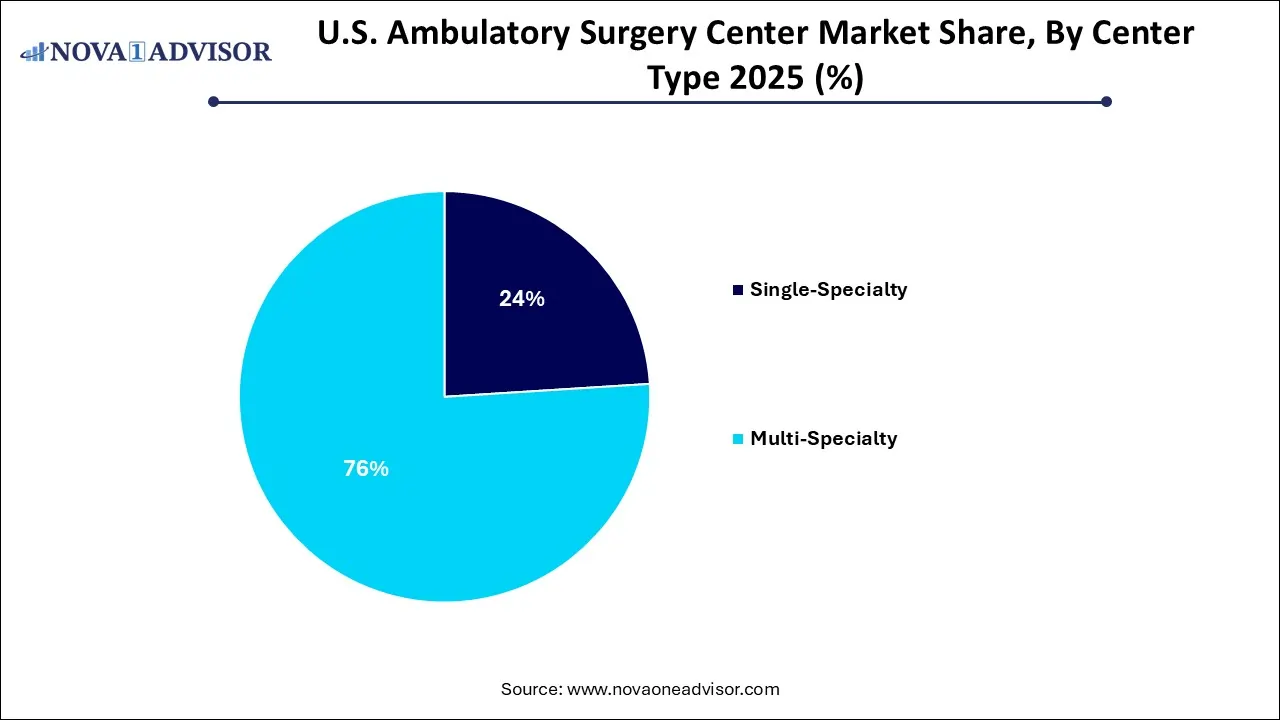

- Based on centre type, the market is segmented into single-specialty and multi-specialty. The single-specialty segment generated the maximum market share of 24.0% in 2025.

- The multi-specialty segment is expected to expand at the highest growth from 2025 to 2035.

What is a U.S. Ambulatory Surgery Center?

Ambulatory surgery centers (ASCs) are advanced medical facilities focused on outpatient procedures. Typically, they concentrate on specific areas like colonoscopy or plastic surgery. These centers are vital because they offer patients convenient and high-quality care. They are heavily regulated by CMS and state authorities to ensure safety and excellence. ASCs specialize in outpatient surgeries and provide personalized, efficient, and cost-effective care. Surgeons can perform a variety of effective same-day procedures, tailored to each patient's individual needs.

Download a Sample Report Here: https://www.novaoneadvisor.com/report/sample/7800

What are the Key Drivers in the U.S. Ambulatory Surgery Center Market?

An ambulatory surgery center (ASC) is a healthcare facility that provides same-day surgical services. Unlike hospitals, where patients might stay overnight, ASC patients usually go home within 24 hours. These centers are highly regulated, accredited, and specialized, often offering the same quality of care as hospitals but at 35–60% lower costs. They perform a variety of procedures across specialties such as orthopedics, gastroenterology, ophthalmology, and cardiology. ASCs serve as an alternative outpatient setting for physicians to conduct procedures, which contributes to the market’s growth.

What are the Ongoing Trends in the U.S. Ambulatory Surgery Center Market?

- In December 2025, CMS launched a five-year Prior Authorization Demonstration for certain ambulatory surgical center (ASC) services in 10 states, including Georgia, Florida, and Tennessee. The model requires ASCs to obtain prior authorization before performing designated procedures that CMS views as high-growth or medically variable, like blepharoplasty, botulinum toxin injections, panniculectomy, rhinoplasty, and vein ablation.

- In 2025, the Centers for Medicare & Medicaid Services (CMS) is expanding its SDOH reporting requirements, with voluntary reporting beginning in 2025 and mandatory reporting taking effect in 2026.

What is the Emerging Challenge in the U.S. Ambulatory Surgery Center Market?

Patients who undergo an operating procedure at an ASC have to travel to distinct conveniences to obtain rehabilitation or follow-up care, which to the expenses and inconvenience. Also, insurance coverage for ASCs is limited to particular outpatient surgical procedures, which limits the growth of the market.

Immediate Delivery Available | Buy This Premium Research: https://www.novaoneadvisor.com/report/checkout/7800

U.S. Ambulatory Surgery Center Market Report Scope

| Report Attribute | Details |

| Market Size in 2026 | USD 46.51 Billion |

| Market Size by 2035 | USD 80.60 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 6.3% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Specialty, By Ownership, By Center Type, By Device Type |

| Market Analysis (Terms Used) | Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Envision Healthcare Corporation; Tenet Healthcare Corporation; Mednax Services, Inc.; TeamHealth; UnitedHealth Group; Quorum Health; Surgery Partners; Community Health Systems, Inc.; SurgCenter; Prospect Medical Systems; Edward-Elmhurst Health; MCKESSON CORPORATION, BD, Koninklijke Philips N.V.; 3M; Olympus America; Zimmer Biomet; GE HealthCare; Abbott; Medtronic; Henry Schein, Inc. |

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us: +1 804 420 9370

U.S. Ambulatory Surgery Center Market Segmental Insights

Specialty Insights

Which Specialty Led the U.S. Ambulatory Surgery Center Market in 2025?

The orthopedics segment accounted for the dominating share of the market in 2025, as ASCs have transformed the outpatient surgery experience by providing exceptional quality care, customer service, and lower costs. Orthopedics is increasing in ambulatory surgery centers, offering targeted and cost-effective care. ASCs lesser infection rates, limited wait times, and enhanced customization, altering how patients receive treatment.

Whereas the cardiology segment is predicted to register rapid expansion in the forecasting period, as ASCs play a significant role in increasing access to advanced-quality cardiology care in the outpatient setting, increasing positive results for patients, doctors, and healthcare stakeholders. Moreover, establishing an outpatient cardiology practice or adding cardiology to the current practice needs extensive planning and number-crunching.

Ownership Insights

Which Physician-Dwned ASCs Dominated the Market in 2025?

In 2025, the physician-owned ASCs segment captured the biggest share of the U.S. ambulatory surgery center market, as physician ownership of an ASC provides an advanced opportunity for doctors with a business spirit. ASCs enable physicians to deliver high-quality, patient-centered care while participating in the economic upside of the business. With the right medicalcare law expertise, doctors thrive as ASC owners.

Although the corporate-owned ASCs segment will expand fastest during 2026-2035, this enables strengthened quality control, effective expense management, and strong results while avoiding large-scale demands for space, resources, and management. These commercial models offer a hybrid strategy where physicians often retain equity while divesting administrative load.

Center Type Insights

How did the Multi-Specialty ASCs Dominate the Market in 2025?

In 2025, the multi-specialty ASCs segment had the largest share in the U.S. ambulatory surgery center market, as in this segment, pair specialties that play well together, sharing similar tools, supplies, and healthcare teams. Multidisciplinary teams in ASCs are a confluence of varied expertise and rationalized communication, forming the foundation of advanced-quality care.

On the other hand, the single-specialty centers segment is expected to grow most rapidly between 2026 and 2035, as single-speciality centers sinificantly focuses more on one precise speciality of treatment. This can be either cardiology or neurology, or maternity care, or any other. These types of specialty centers are more effective and deliver operational benefits relevant to the specialisation compared to general hospitals.

U.S. Ambulatory Surgery Center Market Regional Insights

Why did Southeast Dominate the Market in 2025?

Southeast is led in the market as increasing in the adoption of progressive, affordable technologies, allowing a high volume of surgeries to shift from hospitals to ASCs. growing spending in ASCs and favourable reimbursement rates in this region have driven the growth of the market.

How did the Midwest Grow Notably in the Market in 2026?

Midwest segment is fastest growing in the market as growing partnerships among major national players such as HCA Healthcare and local physician groups. Growing focus on patient-centered, advance-quality care and specialized solutions such as orthopaedics. Technological development, novel surgical techniques that lowers recovery time, and significant spending from healthcare systems, drive the growth of the market.

U.S. Ambulatory Surgery Center Market Key Players List

- Envision Healthcare Corporation: Envision Healthcare provides physician-led services including emergency medicine, anesthesiology, radiology, and post-acute care across hospitals and healthcare facilities.

- Tenet Healthcare Corporation: Tenet Healthcare is a diversified healthcare services company operating hospitals, ambulatory surgery centers, and outpatient facilities. It emphasizes high-quality, cost-efficient care through its Conifer Health Solutions and ambulatory care platforms.

- Mednax Services, Inc.: Mednax specializes in physician services with a strong focus on neonatology, anesthesiology, radiology, and maternal-fetal medicine.

- TeamHealth: TeamHealth is a leading provider of outsourced physician services, primarily in emergency medicine, hospital medicine, and anesthesiology.

- UnitedHealth Group: UnitedHealth Group is a global healthcare company offering health benefits and healthcare services through UnitedHealthcare and Optum.

- Quorum Health: Quorum Health operates a network of rural and community hospitals across the United States.

What are the Recent Developments in the U.S. Ambulatory Surgery Center Market?

- In December 2025, DNV launched accreditation for ambulatory surgery centers. Novel providing builds on DNV’s value-driven strategies to medicalcare accreditation, focusing on continuous enhancement, patient safety, and public health results.

- In December 2025, AMSURG announced the expansion of its portfolio in the Pennsylvania market with the acquisition of Advanced Center for Surgery. The collaboration marks the company’s first center in the central region of the state and reflects its continued commitment to helping independent physician groups.

- In October 2025, PayrHealth and DocSpera announced a strategic partnership intended to support Ambulatory Surgery Centers (ASCs) as they navigate novel Centers for Medicare & Medicaid Services (CMS) needs for patient results reporting.

More Insights Nova One Advisor:

- U.S. General Anesthesia Drugs Market: The U.S. general anesthesia drugs market size was exhibited at USD 1.86 billion in 2025 and is projected to hit around USD 2.46 billion by 2035, growing at a CAGR of 2.84% during the forecast period

- U.S. Biotechnology and Pharmaceutical Services Outsourcing Market: The U.S. biotechnology and pharmaceutical services outsourcing market size was exhibited at USD 11.24 billion in 2025 and is projected to hit around USD 18.24 billion by 2035, growing at a CAGR of 4.96% during the forecast period 2026 to 2035.

- U.S. Roadside Drug Testing Market: The U.S. roadside drug testing market size was exhibited at USD 1.59 billion in 2025 and is projected to hit around USD 2.47 billion by 2035, growing at a CAGR of 4.5% during the forecast period 2026 to 2035.

- U.S. Hemoglobinopathies Markei: The U.S. hemoglobinopathies market size was exhibited at USD 3.99 billion in 2025 and is projected to hit around USD 12.48 billion by 2035, growing at a CAGR of 12.8% during the forecast period 2026 to 2035.

- U.S. IVD And LDT For Autoimmune Diseases Market: The U.S. IVD and LDT for autoimmune diseases market size was exhibited at USD 3.48 billion in 2025 and is projected to hit around USD 5.67 billion by 2035, growing at a CAGR of 5% during the forecast period 2026 to 2035.

- U.S. Biopharmaceuticals Contract Manufacturing: The U.S. biopharmaceuticals contract manufacturing market size was estimated at USD 5.64 billion in 2025 and is expected to surpass around USD 8.45 billion by 2035 and poised to grow at a compound annual growth rate (CAGR) of 4.13% during the forecast period 2026 to 2035.

- North America Point Of Care Diagnostics Market: The North America point of care diagnostics market size was exhibited at USD 21.3 billion in 2025 and is projected to hit around USD 38.71 billion by 2035, growing at a CAGR of 6.16% during the forecast period 2026 to 2035.

- U.S. Biotechnology Market: The U.S. biotechnology market size was estimated at USD 699.25 billion in 2025 and is projected to hit around USD 2,166.96 billion by 2035, growing at a CAGR of 11.98% during the forecast period from 2026 to 2035.

- Single Cell Genome Sequencing Market: The global single cell genome sequencing market size was estimated at USD 5.65 billion in 2025 and is projected to hit around USD 24.97 billion by 2035, growing at a CAGR of 16.2% during the forecast period from 2026 to 2035.

- U.S. Intravenous Immunoglobulin Market: The U.S. intravenous immunoglobulin market size was exhibited at USD 7.85 billion in 2025 and is projected to hit around USD 16.45 billion by 2035, growing at a CAGR of 7.68% during the forecast period 2026 to 2035.

- Automated Microbiology Market: The automated microbiology market size was exhibited at USD 8.69 billion in 2025 and is projected to hit around USD 23.67 billion by 2035, growing at a CAGR of 10.45% during the forecast period 2026 to 2035.

Segments Covered in the Report

By Specialty

- Cardiology

- Respiratory

- Orthopedics

- Pain Management/Spinal Injections

- Gastroenterology

- Ophthalmology

- Plastic Surgery

- Otolaryngology

- Obstetrics/Gynecology

- Dental

- Podiatry

- Others

By Ownership

- Physician-Owned

- Hospital-Owned

- Corporate-Owned

By Center Type

- Single-Specialty

- Multi-Specialty

By Device Type

- Cardiology

- Orthopedics

- Pain Management/Spinal Injections

- Ophthalmology

- Plastic Surgery

- Spinal Surgery

- Respiratory

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research: https://www.novaoneadvisor.com/report/checkout/7800

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Nova One Advisor

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn